In a two-day meeting of the GST Council today, several major decisions were taken to provide relief to the public. To simplify the tax structure, the council scrapped the 12% and 28% tax slabs. Now, only two slabs—5% and 18%—will remain. Additionally, many essential goods have been exempted from tax altogether.

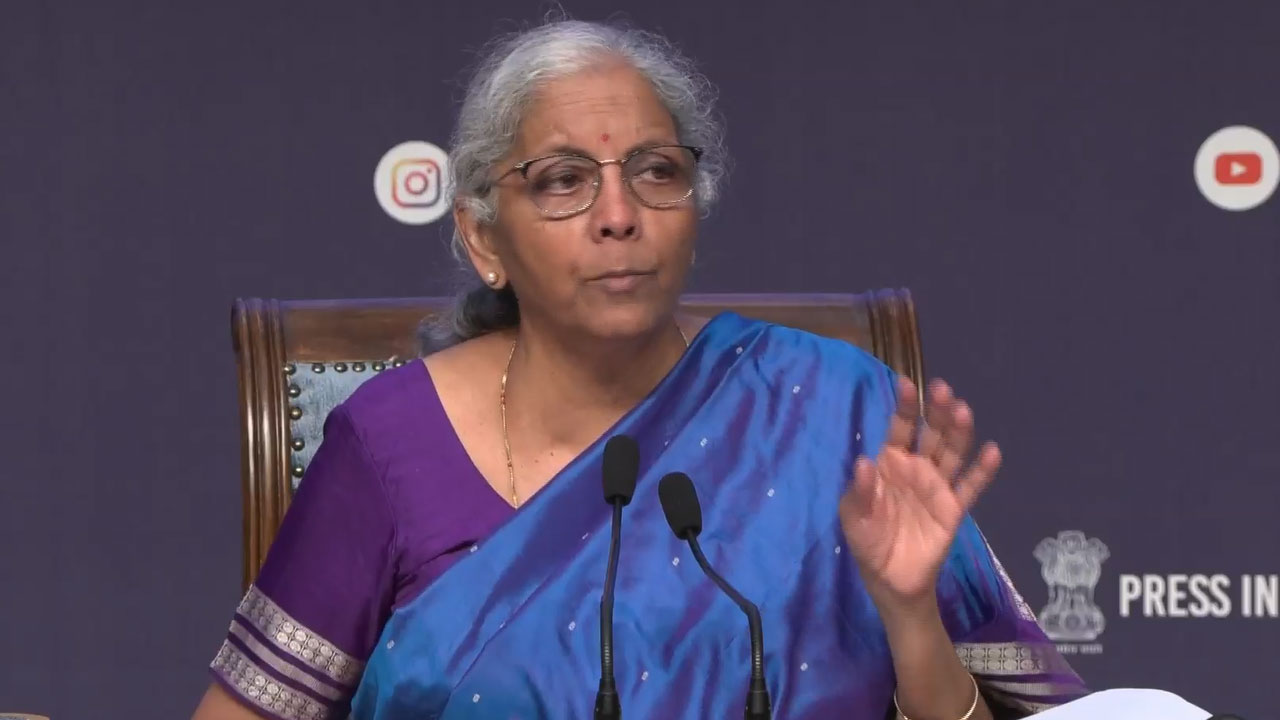

After the meeting, Union Finance Minister Nirmala Sitharaman said the government’s focus is to give direct relief to the common man, the middle class, and labor-intensive industries. She added, “To provide greater relief, the 5% slab has been reduced to zero, while the 12% and 18% slabs have been merged into 5%.”

Key Decisions

- Agriculture & Healthcare Relief:

GST on agricultural machinery has been reduced from 12% to 5%. Meanwhile, 33 life-saving drugs have been completely exempted from GST. Rates on several other medicines have been cut from 12% to 5%. - Construction Sector:

GST on cement has been slashed from 28% to 18%, a move expected to benefit the real estate and infrastructure sectors. - Vehicles & Consumer Goods:

GST on commonly used vehicles has been reduced from 28% to 18%. - Tobacco Products:

In a move aimed at public health, the council decided to impose up to 40% GST on tobacco products.

The Finance Minister confirmed that this new GST framework will come into effect from September 22. She expressed confidence that these reforms will not only bring down inflation but also boost production and consumption.